Click to download now, finish the installation quickly, and directly unlock the "all-round experience"

About This App

🏆 Expert Verdict & Overview

Build & Fix Credit - Dovly AI is a formidable entrant in the crowded credit-management FinTech space. It distinguishes itself by leveraging artificial intelligence not just for passive tracking, but for proactive credit repair and building. This dual-action approach of fixing inaccuracies while simultaneously offering tools to build a positive credit history places it in a unique position between traditional dispute services and educational credit-building apps, offering a compelling all-in-one solution for users serious about improving their financial standing.

🔍 Key Features Breakdown

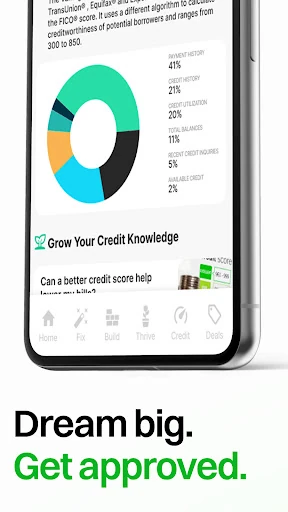

- AI-Powered Credit Engine: Analyzes your credit profile to identify the most impactful actions to boost your score, moving beyond generic advice to deliver a personalized, results-driven strategy.

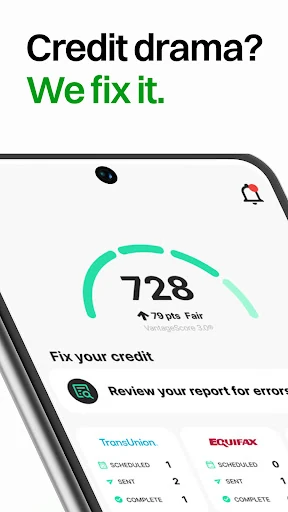

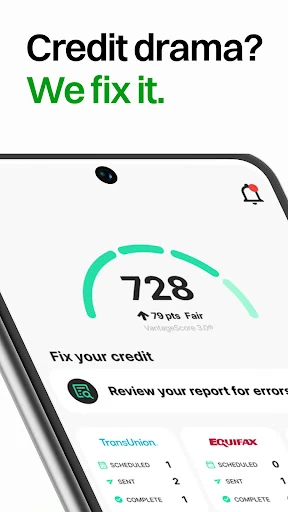

- Automated Dispute System: Streamlines the traditionally arduous process of challenging credit report errors with TransUnion, saving users significant time and effort compared to manual disputes.

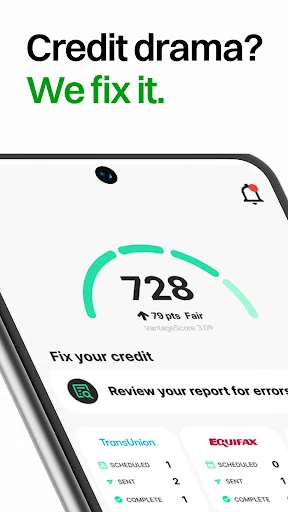

- Consolidated Monitoring: Provides free monthly TransUnion credit scores and reports within the app, eliminating the need to juggle multiple services for basic credit monitoring.

- Credit Lock & Fraud Protection: Integrates essential security features to help users proactively protect their identity and prevent new account fraud, addressing a key user anxiety.

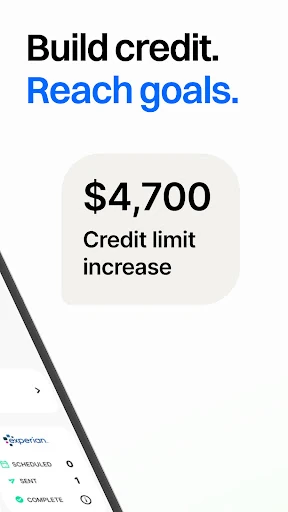

- Personalized Guidance & Tools: Offers tailored tips and specific credit-building tools (e.g., akin to Kikoff's model) designed to help users establish or strengthen their credit history based on their individual situation.

🎨 User Experience & Design

The app's value proposition heavily hinges on a simplified, unified user experience. For the Finance category, where complexity can breed anxiety, consolidating dispute filing, score tracking, educational content, and security features into a single dashboard is a significant UX win. The promise of an AI-driven "engine" suggests a setup-and-forget ease of use, which is highly appealing. Success depends on the UI clearly visualizing progress milestones, credit factors, and the AI's actionable insights in an intuitive, non-intimidating manner to maintain user engagement over the long term needed for credit improvement.

⚖️ Pros & Cons Analysis

- ✅ The Good: The core AI-driven automation for credit repair is a powerful differentiator that directly tackles a painful, manual process for users.

- ✅ The Good: Unifying multiple credit services (monitoring, disputes, building tools, protection) into one free app provides exceptional value and convenience.

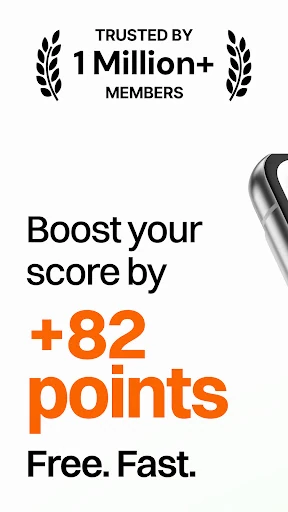

- ✅ The Good: Publishes specific, quantifiable result metrics (average 82-point boost) which builds credibility and sets clear user expectations.

- ❌ The Bad: Heavy reliance on AI and automation may create a "black box" feeling for users who want more transparency or manual control over dispute processes.

- ❌ The Bad: As with any app handling supremely sensitive financial data, the privacy policy and data security practices require thorough user scrutiny, which some may find daunting.

🛠️ Room for Improvement

To deepen user trust and effectiveness, future updates should focus on enhanced transparency. This could include a more detailed, step-by-step log of AI-generated dispute actions filed on the user's behalf and clearer explanations for its recommendations. Introducing features like a savings goal tracker tied to credit milestones or basic budgeting tools would further contextualize credit health within overall personal finance, increasing the app's stickiness. Additionally, securing integrations with Experian and Equifax beyond TransUnion would provide a truly comprehensive credit picture.

🏁 Final Conclusion & Recommendation

Build & Fix Credit - Dovly AI is highly recommended for individuals who are overwhelmed by the complexity of credit repair or who have been unsuccessful with passive monitoring apps alone. It is particularly well-suited for first-time credit builders and those with specific errors dragging down their scores. The app's potent combination of AI-driven automation and a unified toolkit offers a legitimate, hands-on path to credit improvement. Users should approach with realistic timelines for credit change but can expect a sophisticated and proactive partner in their financial journey.